How to Ensure a Fair and Transparent Division of Personal Property

- DMS

- Feb 25

- 5 min read

When families think about estate planning, they often focus on stock portfolios, bank accounts, and homes. But what about the physical belongings left behind—furniture, jewelry, artwork, and sentimental keepsakes? These items may not always have high monetary value, but they can carry deep emotional significance.

Unfortunately, personal property can be one of the biggest sources of conflict after a loved one passes away. Without a clear plan, families can struggle with disagreements, resentment, and even legal battles. A fair and transparent process for dividing personal property can help ensure that everyone feels respected, family bonds remain intact, and important heirlooms go to the right people.

Here’s how you can create a smooth, conflict-free system for distributing personal property as part of your estate plan.

1. Start Planning Early—Don’t Leave It to Chance

Many people assume that their loved ones will “work things out” after they’re gone. But when grief is involved, emotions run high, and even minor disagreements can escalate. The best way to prevent disputes is to make a plan in advance.

What You Can Do:

Create an inventory of your belongings. Take note of any significant personal property, including heirlooms, collections, and sentimental items.

Decide on a distribution method. Will you gift items while you’re still alive? Will family members select items in an orderly process?

Talk to your family about your intentions. Discussing your wishes early helps avoid surprises and confusion later.

By starting early, you take control of the process rather than leaving difficult decisions to your loved ones.

2. Be Clear and Specific in Your Estate Plan

A will alone may not be enough to divide personal property fairly. Unlike financial assets, which can be split evenly, physical items are unique—only one person can inherit Grandma’s wedding ring or Dad’s military medals. Without clear instructions, disputes can arise.

What You Can Do:

Use a Personal Property Memorandum. This is a legal document in many states that allows you to list specific items and who should receive them. It can be updated over time without changing your entire will.

Avoid vague language. Instead of saying, “My children should divide my belongings fairly,” be specific about what should happen to key items.

Consider sentimental value. A family heirloom may be more valuable to one person than another. Recognizing this can help with fair distribution.

Providing clarity in your estate plan eliminates guesswork and ensures your wishes are honored.

3. Use a Fair Selection Process

If you’re dividing personal property among multiple heirs, a structured process can help prevent arguments.

Common Methods for Fair Distribution:

The Round-Robin Method: Heirs take turns choosing items, ensuring everyone gets a fair share of valuable and sentimental belongings.

Point or Bidding Systems: Each heir is given a set number of points or tokens to “bid” on items they want most.

Family Discussions with Mediation: If possible, gathering as a family to discuss preferences and make compromises can work—especially if an impartial mediator is present.

Regardless of the method, the key is to make the process structured, transparent, and agreed upon in advance.

4. Encourage Open Conversations About Sentimental Items

Many family conflicts arise not because of financial value but because of emotional attachment. An old rocking chair might be worthless in dollars but priceless in memories.

What You Can Do:

Ask family members what’s important to them. You may assume a certain child wants a particular heirloom when, in reality, someone else values it more.

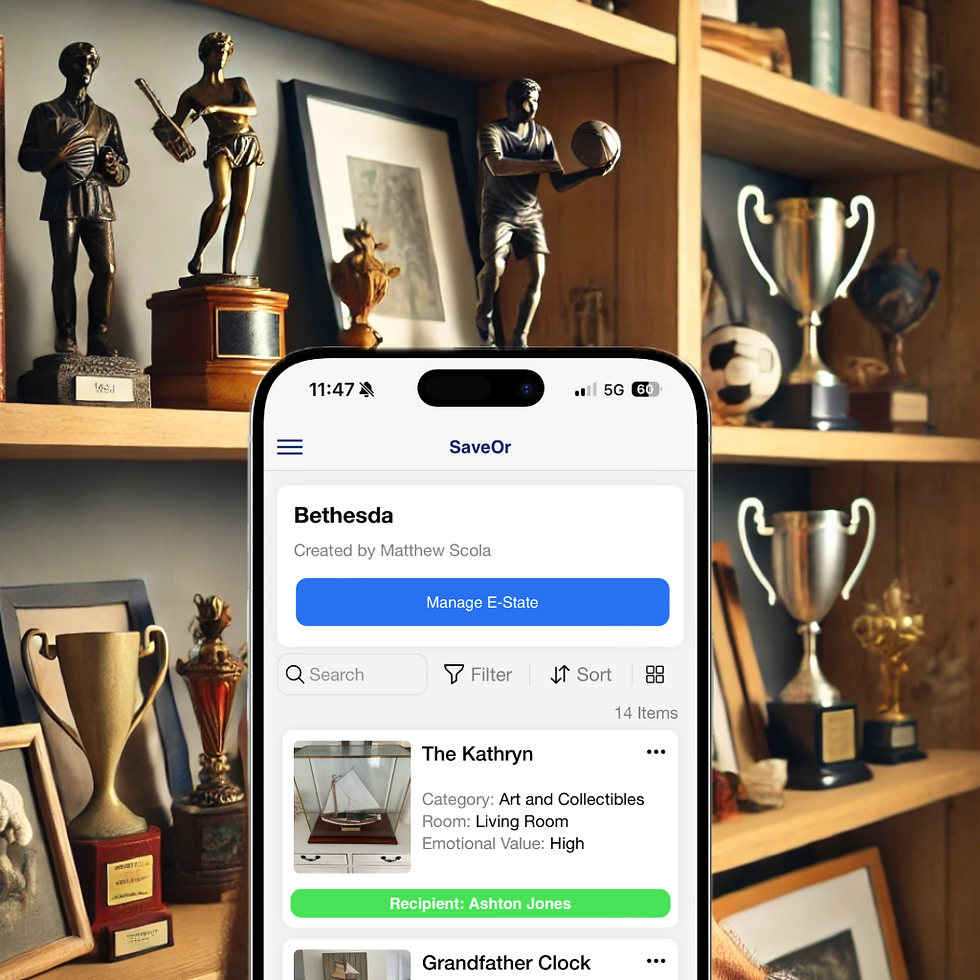

Use technology to facilitate discussions. A platform like SaveOr allows family members to indicate interest in items before decisions are made.

Share the stories behind heirlooms. Often, knowing the history of an item makes it more meaningful to those who inherit it.

Having these conversations before a loss occurs helps family members feel heard and respected.

5. Use Technology to Document and Organize Property

In today’s digital world, estate planning tools can simplify the process of managing personal property. Instead of relying on paper lists or verbal agreements, technology allows you to create a detailed, accessible inventory.

How SaveOr Can Help:

Create a Digital Inventory: Photograph items, record their stories, and assign them to future recipients.

Allow Family to Express Interest: Heirs can indicate which items they’d like, reducing surprises and conflicts.

Generate a Legally Recognized Document: Export a Personal Property Memorandum that can be included in your estate plan.

Keep Everything Transparent: A digital platform ensures that decisions are documented and visible to all family members.

By integrating technology into estate planning, families can make the division of personal property clear, fair, and conflict-free.

6. Consider Gifting Items During Your Lifetime

One way to eliminate disputes over personal property is to pass down meaningful items while you’re still alive.

Benefits of Gifting Early:

You can see your loved ones enjoy the items. Instead of wondering what will happen to your belongings, you get to witness their appreciation.

It prevents future disagreements. By making decisions yourself, you eliminate the need for family members to negotiate after you’re gone.

It reduces the burden on your estate. Fewer possessions left behind means a simpler estate settlement process.

If there are specific items you want to go to certain individuals, consider gifting them now rather than waiting.

7. Bring in a Neutral Third Party if Needed

Even with the best planning, conflicts can arise. In cases where disagreements seem inevitable, a third-party mediator or estate attorney can help guide the process fairly.

When to Consider a Mediator:

When siblings have conflicting interests in the same item.

When family history includes tension or unresolved conflicts.

When there is confusion over a loved one’s wishes.

An impartial expert can ensure that decisions are made based on fairness, not emotions.

Final Thoughts

Dividing personal property in an estate can be one of the most challenging aspects of inheritance—but it doesn’t have to be. By planning ahead, using clear documentation, and leveraging technology, you can make the process smooth and conflict-free.

The goal isn’t just about fairness; it’s about preserving family relationships and honoring your legacy. With platforms like SaveOr, families can document, organize, and distribute personal property in a way that ensures transparency, clarity, and peace of mind for everyone involved.

Taking the time to create a structured, fair plan today will save your loved ones from unnecessary stress and allow them to focus on what truly matters—cherishing the memories and legacy you leave behind.

Author:

Matthew Scola

Founder of SaveOr, an estate planning platform focused on helping families through challenging life events. His insights come from interviewing and working with families and professionals to find a solution to the challenges of downsizing, estates, and estate management.